All About Users’ Search on the AppStore

With the available hundreds of thousands of mobile application software, the user’s search experience is of importance right from the developers, mobile advertisers, and project managers. The ease with which users manage to locate a certain brand translates to product returns. Therefore, while deploying an application on the app store, things such as search experience and visibility are some of the things that developers should highly regard. As a result of such needs, it is an obvious thing for every group of mobile marketers and developers to seek for unique searches mechanism for their products to stand out of the stack.

Notably, over 47 % of app users were found to have discovered about certain brands through search engines. Mainly, Android which runs most of the world’s devices, 53% percent gave a revealing of having learned of the apps they use from Google play search. Perhaps one crucial question worth considering is what it is a user type on the search box in a bid to find the app they desire. Notably, searches on the app stores happen to be entirely different from web ones which makes it a nightmare to developers, project managers, and mobile advertisers. Therefore, achieving a brand name that would see users to quickly identify it happens to be a big plus and at the same time a challenge.

Considering that an average mobile user at any one time runs about 80 different applications, optimizing your brand for easy identification is something of great importance. A range of efforts goes into the utilization of ads to make advertisement of certain app products which in a big way facilitates the efforts of making mobile users aware of the existence of particular software. Such publication takes place over the web with app store providing the search patterns of mobile app users.

One of the most significant search methods that mostly facilitate users to locate certain brands is the use of keywords. John Koetsier study on the most used keywords found out that, nine out of every ten main words belong to brands. An interpretation of this study reveals that users search for products that they happen to be familiar with or ones that they have heard. Another notable finding is that most of the unbranded keywords relate to games and utility apps such as photo editors, calculators, and music among others. Therefore, such results are clear indications on the importance of using appropriate brand name one that the users can easily recall for downloads.

Users’ search requests apart from brand names

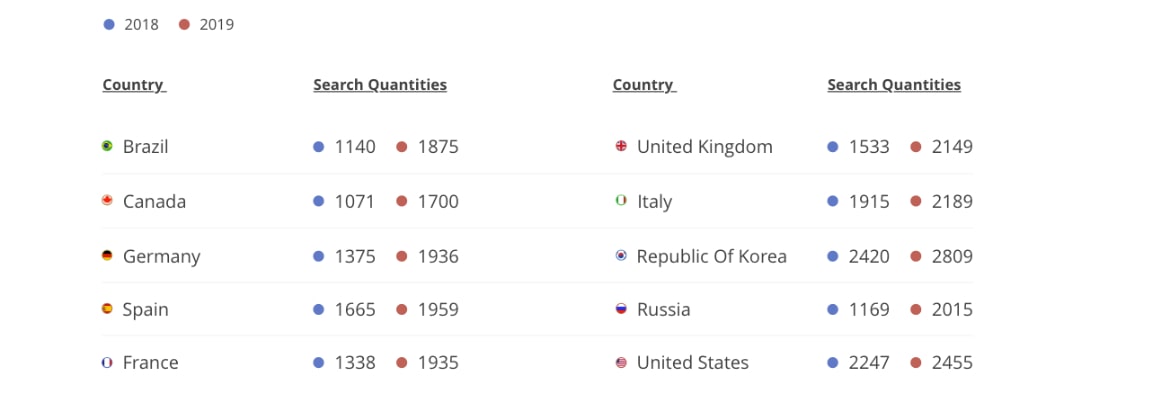

According to these unique data, users are searching for twice as many high volume queries in 2017, than in 2015. There were 2.455 unique search phrases trending in the USA in 2017. And up from 2.247 in the year 2016.

App users exhibit two different types of searches on the various application stores. These include blind and informed exploration. Blind search entails users who get into app stores and use multiple keywords in an attempt to find an application. The other group of search is where the user happens to be well aware of what it is they want.

These two search types are categoric and navigational queries search categories according to Ankit Jain analysis. Categorical mostly utilizes broad search terms while navigational entails the use of exact search terms. With more than six million unique search phrases monthly according to Jain, the information provides adequate data for advertisers to make their brands discoverable. More importantly, it is worth noting that over the years, the volume of searches continues to increase perhaps giving an insight into the high number of uncertain users.

Autocomplete and what it tells about search behavior

Various features exist which facilitates user’s application search efforts. Autocomplete is one such feature that works by suggesting the most likely results as the user keys in letters on the search engine. A pop-up list under the keyed characters provides a quick way for the users to find whatever it is they intend. It is essential for the mobile advertisers to note that most of the available app stores utilize a two letters combination (A to Z) and a priority score assigned by the service provider.

It is worth noting that, unbranded products that autocomplete feature offers on the app store represents five percent. Therefore, this reveals how important branding is and mobile advertisers and project managers should consider if their apps are to make considerable returns. Results from a study done regarding autocomplete phrases on the apple store, free, apps, news, and games are some of the most branded items that appear on the autocomplete list.

The Answer for App Developers

To enable successful search, developers, project managers, and mobile advertisers need to ensure that users have an understanding of their product. As a consequence of user understanding of the existence of particular software, they become informed on what and how to search and the query they should use. Developers need to understand that it is within their capability to solve secrets behind the use of longer keywords tails. However, brands still accept the use of short and mid-tail keywords for apps search although in a limited manner. For Google developers, the corporation rolled out a new organic search data under the “user acquisition” on its play console. The operational search data explores to facilitate the beta-testers group efforts by allowing one to make dedifferentiation of play store organic-traffic as either browsing or as a search.

Additionally, it enables the developers to identify the type of operation which led the user to their product, that is, is it through browsingor search? More so, it doubles up as an excellent feature as it enables developers to identify installations made per keyword. That way, developers can modify their strategies effectively in line with consumer’s behavior. The move by Google to provide the top 1000 search terms, buyers and conversion rate goes a long way in facilitating the efforts of project managers, mobile advertisers, and developers. There is more hope for app marketers going into the future as more data on how users search their apps becomes available. However, they will have to wait a bit for completion of the mechanism of acquiring and verifying of such data.